How do Credit Bureaus calculate your Credit Score?

October 26, 2022

Rental Agreement: Rights and Duties of Landlords and Tenants

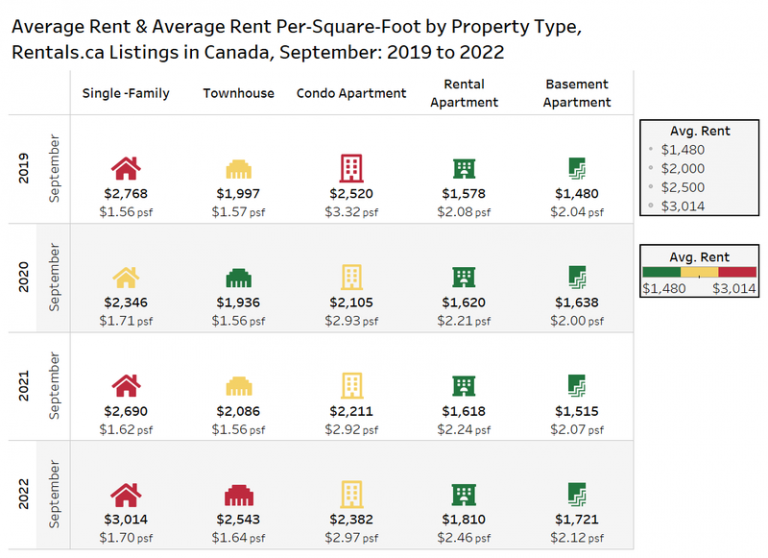

November 8, 2022The average cost to rent an apartment increased by 15.4 percent from September 2021 to September 2022, according to the latest national rent report from rentals.ca. On a month-to-month basis, average rent rate increased by 4.3 percent. This monthly increase is the highest since 2018, as per the report. The monthly rent is increasing correspondingly with the average monthly demand for all types of units. Rent increase is impacting single-family homes, condo apartments, rental apartments, townhouses, and basement apartments. Meanwhile, the rental demand keeps increasing as a result of hiking interest rates that are preventing Canadians from entering the real estate market and owning houses.

Factors affecting the deterioration of household affordability

Increase in house prices

According to a report by CEIC Data, there was a 6.9 percent increase in house prices in Canada in August 2022 following a yearly increase of 7.5 percent in the previous month. The report sheds the light on the aftermath of the pandemic and the Russo-Ukrainian war. Both factors have contributed to the soaring prices of construction materials, and this is directly mirrored in rental and homeownership affordability.

Interest rates hike

As part of the measures to curb inflation, the Bank of Canada keeps increasing interest rates. Mortgage interest rates are expected to reach a six percent high by the end of the fourth quarter of 2022. The upcoming Fed meeting -before the end of the year– is expected to bring new interest-rate hikes.

Population Growth

According to Statistics Canada, the country witnessed a 0.7 percent increase in population in the second quarter of 2022. The survey recorded the highest quarterly increase since 1957. As a matter of fact, immigration policies are attracting newcomers leading to population growth intended to fill the gaps in the workforce. Naturally, immigrants cannot afford home ownership on their arrival, so they opt for a reasonably-priced-alternative, rental.

Trends in new construction increasing rental prices

Canada is witnessing the rise of dwellings constructions dedicated to rental. Built for rental purposes, the rise of large and more expensive units keeps growing, as per the rentals.ca report.

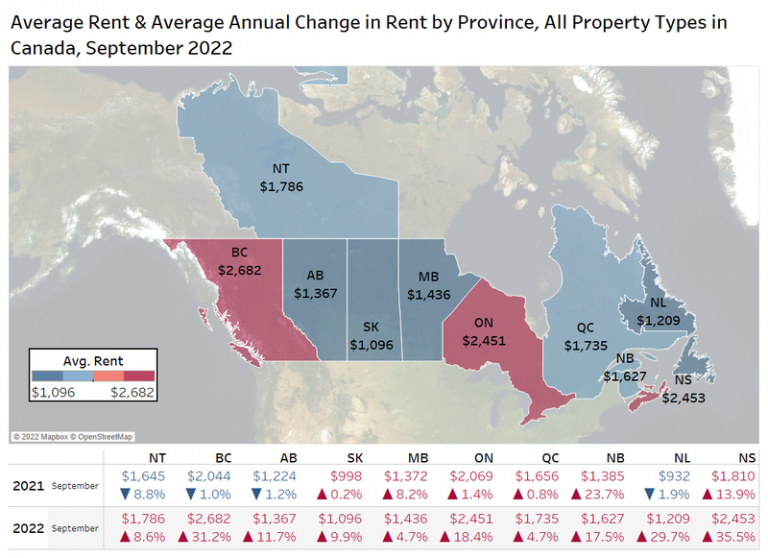

Nova Scotia recorded the highest rental increase

Average rent in the North Atlantic province reached $2,453 in September 2022, a 35.5 percent increase compared to September 2021. According to rentals.ca, people started moving to Halifax after the pandemic. They discovered the beautiful landscapes of Nova Scotia and decided that it was an impressive place to dwell in. In addition to the beautiful scenery, five of the top ten municipalities over the past three years are in Nova Scotia. Burnaby came out on top and the other five are Vancouver, New Westminster, Richmond, and North Vancouver.

Paying your rent is rewarding with Dwello

Increasing mortgage rates and utility expenses are directly impacting rent prices. It is becoming more difficult for both renters and landlords. However, with Dwello both parties are saving time and effort. The upgraded and innovative concept at Dwello is offering users whether tenants or landlords the opportunity to unlock savings and financial benefits that will reward the tenants as they pay rent and reduce churn for landlords and improve their profitability. Automated payments through Interac Integration make the tenants’ payments faster, simpler, and easier to track. Payments are directly reported to the credit bureau with Dwello. Users can regularly track their credit report for FREE. With this integrated feature, users are encouraged to keep a healthy financial relationship with their landlords, because after all who would want to negatively impact their creditworthiness? Contact us to know how Dwello will help you build your credit score as you pay rent